Bernt Nelson, American Farm Bureau Economist

Cold storage, particularly for red meat and poultry, is an important part of the protein supply chain, with meat in cold storage coming from a variety of sources and used in both domestic and global markets. This Market Intel evaluates USDA-National Agricultural Statistics Service’s March Cold Storage report, released on March 25, and analyzes overall supply and demand for animal proteins in 2024.

What’s in the report?

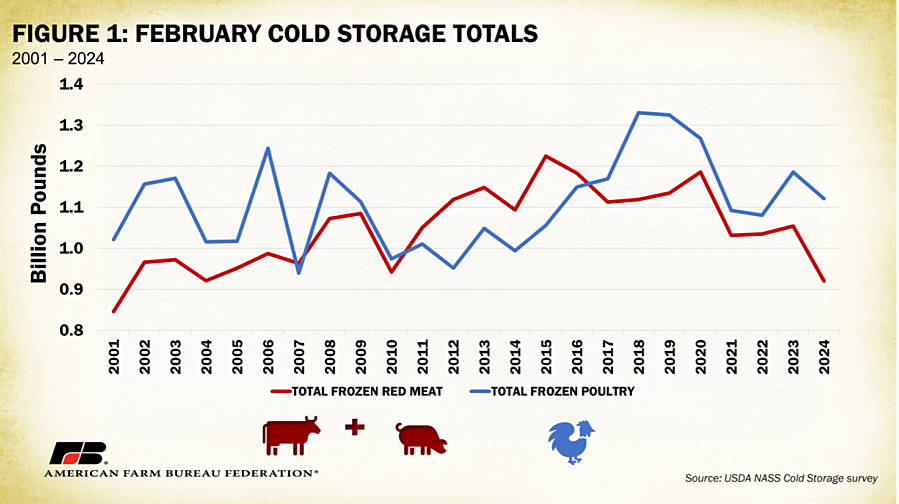

USDA’s monthly Cold Storage report measures reserve food supplies held in commercial and public warehouses. All stocks in the March report represent inventory in cold storage on Feb. 29, 2024. Red meat in freezers was estimated to be 1.05 billion pounds, down 4% from February 2023 and the lowest it has been in 23 years (Figure 1). Frozen poultry stocks, a separate measure from red meat, were 1.03 billion pounds in February 2024, down just 1% from last year. These changes were somewhat expected since nearly all animal protein sectors are experiencing or will experience lower inventories in 2024 and beyond. When the supply of any commodity falls, it’s common for market volatility to increase. When demand simultaneously remains strong, prices typically move higher.

Beef

Also published on March 25, USDA’s monthly Cattle on Feed report indicates that there were 11.8 million head of cattle on feed on Mar. 1, up 1% from the same time in 2023. Farmers placed 1.89 million head of cattle on feed in February, up 10% from 2023 and the highest on record for any February. This indicates that there is still more liquidation occurring in the U.S. cattle industry.

While this elevated number of cattle on feed will help keep beef prices at the grocery store suppressed, it’s important to consider the declining cattle inventory and the decreasing quantity of beef in cold storage. When placements begin to fall, there won’t be cattle available to replace them. A drop in the supply of beef will follow, resulting in smaller amounts of beef held in freezers. USDA’s estimate of beef in cold storage on Feb. 1 was 442.75 million pounds, the lowest in a decade.

Pork

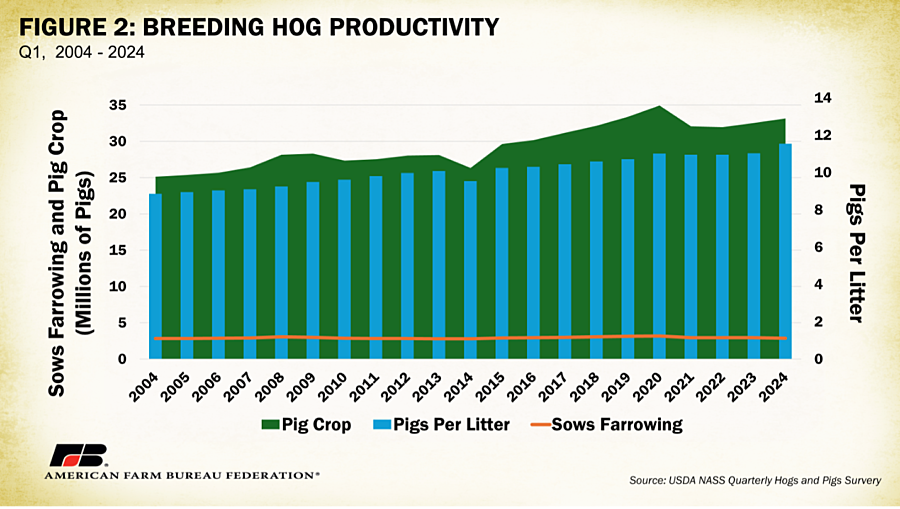

USDA’s Quarterly Hogs and Pigs report, released March 28, contains data from 16 major production states including total inventory, farrowings, farrowing intentions, pigs per litter, and pig crop for each respective quarter of the year. The first quarter sets the tone for the year.

The total inventory of hogs and pigs in the United States on March 1 was 74.6 million head, up 1% from 74.14 million head in 2023. The breeding inventory was 6.02 million head, down 2% from 6.15 million head in 2023. The December 2023-February 2024 pig crop totaled 33.1 million head, up 2% from the first quarter of 2023. Sows farrowing were 2.88 million, down 3% from 2023. Pigs per litter was record high at 11.53, up from 11.02 during the first quarter of 2023. This is the seventh consecutive record-high quarter for pigs per litter and is convincing evidence that increases in production efficiency are offsetting any culling that may be happening in breeding hogs.

The report indicates that producers intend to farrow 2.92 million sows during the second quarter of 2024, just 1% below the second quarter of 2023. If production efficiency continues, the pig crop for the second quarter will increase (Figure 2).

On the demand side of things, domestic demand for U.S. pork is expected to increase in 2024. Wholesale cutout value is expected to be supported by high prices for substitutes such as beef, which is expected to hit record-low levels in 2024. Total 2024 pork production is estimated at 27.9 billion pounds, up 2.2% from 2023. Exports are forecasted at 7.1 billion pounds, up 4.6% from 2023 due to higher production, and less global competition from a regulatory, cost-drivendrop in production in the European Union. It is typical for U.S. meat demand to pick up as spring turns to summer and grilling season gets underway. This will provide price support for all meat sectors, including pork.

Proposition 12

California’s Proposition 12 continues to contribute to uncertainty and price volatility in the pork markets. USDA livestock mandatory reporting (LMR) differentiates between Prop-12-compliant and non-compliant products. Prop-12-compliant volumes reported in USDA’s LMR initially jumped to about 4% of U.S. pork production by volume in January 2024 before falling to 1.5% in February. Since then, compliant production has slowly risen to about 2%. Estimates suggest Prop-12-compliant pork volumes need to be near 6% of all U.S. production to meet California demand. Current Prop-12-compliant production falls far short of this benchmark.

According to a recent study by the University of California Giannini Foundation of Agricultural Economics, the initial price impacts of Prop 12 are much stronger than initially expected. Average retail prices for bacon in California after the implementation of Prop 12 are up 16%, rib prices are up about 17%, and loin prices are up about 41% compared to pre-Prop 12 prices.

Poultry & Eggs

Frozen poultry stocks, addressed earlier in this article, are down 1% from 2023. Increased broiler production is largely responsible for maintaining 2024 frozen poultry stocks while turkey production is expected to fall. Data from USDA’s March Chicken and Egg report indicates broiler-type chicks hatched in February are 789 million, up 3% from February 2023. February egg production was 8.62 billion eggs, up 5% from 2023. This includes nearly 7.4 billion table eggs. Egg-type chicks hatched in February totaled 55.7 million, up 7% from 2023. This increase in production is a reflection of the efforts of poultry growers to combat highly pathogenic avian influenza and keep poultry prices affordable for consumers.

Highly Pathogenic Avian Influenza

The H5N1 HPAI strain has affected millions of birds since the outbreak began in February 2022. Detections are higher in both the spring and the fall as migratory birds make their way to their seasonal homes at that time. Farmers and brood stock producers have been diligent in keeping strong biosecurity protocols in place that have allowed growers to rebuild inventories, as demonstrated in USDA’s chicken and egg report. Spring migratory bird movement typically lasts into May, along with the risk of higher detection rates. Increased detections of HPAI could lead to increased price volatility, especially in the egg sector. Most recently, an egg producer in Texas announced the culling of 1.6 million egg laying hens due to HPAI. A slight rise in egg prices followed. The combined regional average price for a dozen Grade A large eggs increased 11%, from $2.24 on March 22 to $2.49 on April 5.

Recently, USDA, the Food and Drug Administration and the Centers for Disease Control and Prevention (CDC), as well as state veterinary and public health officials, began investigating an illness primarily found in older dairy cows. Dairy herds have tested positive for HPAI in Texas, Kansas, New Mexico, Michigan, Idaho and Ohio. The CDC has released a statement that the risk to the public is low and milk is safe to consume. Milk from sick animals is not permitted to enter the supply chain. As an added precaution, pasteurization kills both bacteria and viruses, including HPAI. HPAI will be discussed further in a future Market Intel.

Conclusions

While changes in food animal inventories are normal, it is abnormal for all of them to decline at the same time. Beef, pork and poultry held in freezers are all below year-ago levels, with beef falling to levels not seen in a decade. All these protein inventories are declining for different reasons. Frozen beef supplies are declining due to overall herd liquidation. Pork is facing profitability issues along with market segmentation complications caused by Proposition 12. Lastly, the poultry sector is continuing to battle HPAI. These obstacles have resulted in a drop in frozen supplies in all three categories. When supplies fall and demand remains strong, prices rise. Rising prices are an obstacle not only to maintaining domestic demand, but global demand as well.