By Daniel Munch, AFBF Economist

2023 has already yielded its fair share of major weather disasters. The National Oceanic and Atmospheric Administration has confirmed 15 weather disasters with total economic losses exceeding $1 billion each as of August 8. This does not include potential billion-dollar events still being assessed, such as the extensive flooding in Vermont and New Hampshire in July and ongoing drought conditions in the Midwest. Additionally, more recent disasters such as Hurricane Hilary in California and the disastrous Maui fire in Hawaii have not yet been considered. In any case, the onslaught of weather and climate disasters continues to challenge farmers and ranchers, contributing to market uncertainty as we enter prime harvest season for some of the nation’s most popular crops. Dry conditions have also returned to the Mississippi River region, lowering water levels, which could again complicate transportation during the most important agricultural shipping period of the year. Extreme heat in the Southwest and along the Gulf Coast further risks crop quality as well as the health of rural residents and livestock.

Drought conditions in the United States in 2023 have differed from previous years. The severe (D3) and exceptional (D4) drought conditions that have plagued Western states since 2020 was drastically reduced after substantial winter precipitation restored mountain snowpack and inundated parched fields. In the first quarter of the year, prominent agricultural communities in California faced devastating flooding that destroyed high-value specialty crop fields, drowned dairy cattle and chickens and left many without a path forward. Initial estimates, even before Hilary, put total economic losses at more than $4.6 billion across affected regions of California.

Drought conditions, however, are still present in other regions of the nation. Western sections of the Midwest, in states such as Kansas and Nebraska, have faced exceptional drought conditions since summer 2022. Last year, drought conditions resulted in $2 billion and $3.4 billion in crop losses in those states, respectively, and fueled vast liquidations of beef cattle. Drought conditions in other Midwest states such as Iowa, Missouri, Wisconsin and Minnesota have worsened since the end of May. Additionally, drought has intensified along the coastal regions of Texas and Louisiana throughout the summer. As of August 8, over 50% of the nation is categorized as abnormally dry or worse. Drilling down, 65% of the Midwest, 63% of the South and 50% of the West face abnormally dry conditions.

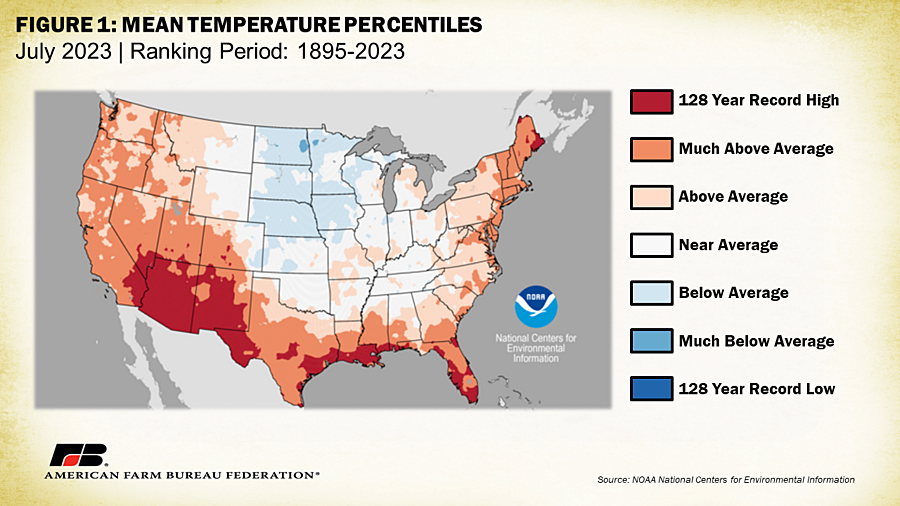

Drought in some regions has been paired with excessive heat. In Alexandria, Louisiana, for instance, during the 22-day span between July 25 and August 15, the daily high temperature was 100°F or higher. Mean temperatures in July were at a 128-year record high for much of the Gulf Coast, Southwest and parts of Florida and Maine. Reports out of Louisiana describe the direct deaths of livestock associated with heat exposure as well as forced liquidations and early calf weaning due to abysmal forage conditions. Louisiana State University economists estimated forced downsizing and cattle losses could result in between $135 million and $291 million in losses representing between 35 and 75% of the annual farm gate value of the Louisiana beef cattle industry with national impacts likely much higher. Dry conditions also make farmers more reliant on irrigation to water crops and prevent yield and quality losses. Farmers with access to water must consider the costly decision of purchasing more fuel to run irrigation equipment more intensely or risk revenue losses. Dry and hot conditions have also increased the prevalence of fires that often destroy crops and endanger livestock and rural families.

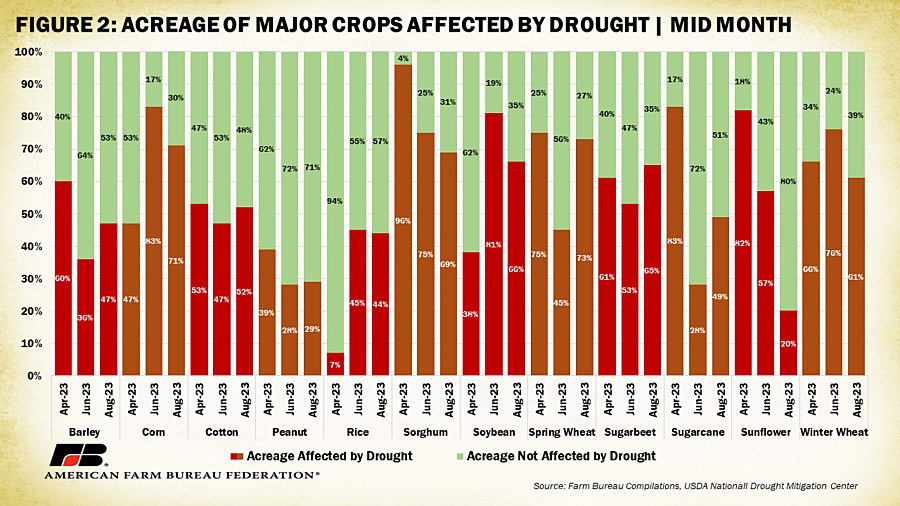

As harvest intensifies in some of these impacted regions, heat and drought will impact the ending quality and quantity of yields. Between June and August there were modest improvements in drought conditions on corn and soybean acreage. Acreage of corn under abnormally dry conditions or worse moved from 83% in mid-June to 71% in mid-August. Similarly, acreage of soybeans under abnormally dry conditions or worse moved from 81% to 66% during the same timeframe. Other crops’ conditions have not improved. For example, 7% of rice acreage was affected by drought in mid-April compared to 45% and 44% in June and August, respectively. Cotton production has remained steadily impacted by drought with between 47% and 53% of acreage affected since April. Over 60% of spring and winter wheat production remains on acreage impacted by drought conditions, contributing to near-record abandonment rates. In 2022 $4.52 billion in corn, $3.25 billion in cotton and $2.64 billion in wheat were lost to drought and other major weather disasters.

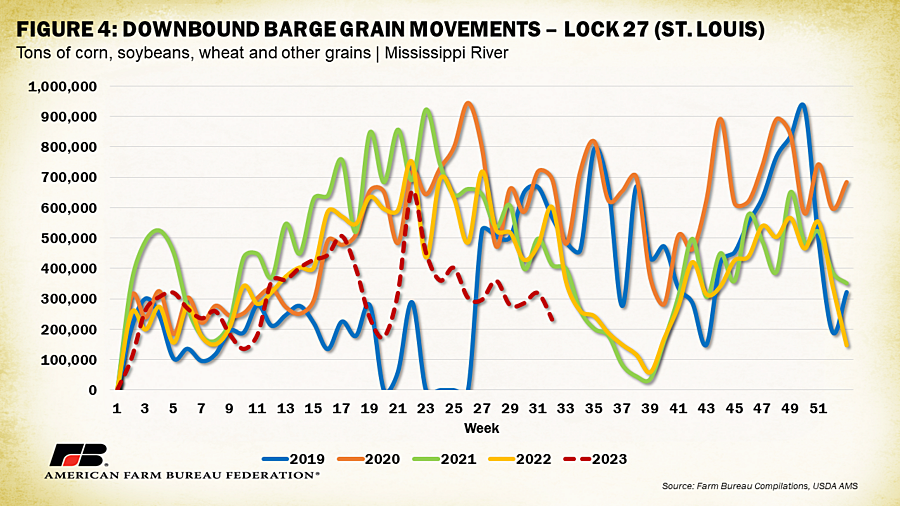

Dryness in the Midwest has also once again dropped water levels on the Mississippi River, a major thoroughfare for grain, to levels threatening barges’ ability to effectively navigate. According to the U.S. Army Corps of Engineers, the stage, or height of the river’s surface relative to the zero-stage level of 379 feet above standard sea level at St. Louis is 1.13 ft as of August 22, 46% lower than the prior three-year average of 4.37 feet and 24% below last year’s level of 1.49 feet on the same day. Average stage levels for the month of August remain slightly above last year’s, though levels may drop lower. Between 2015 and 2019, 95% of corn, 94% of soybeans and 45% of wheat moved by barge traveled through the Mississippi River system to Louisiana, making the river the most significant inland waterway for grain movements. This corresponds to an average annual volume of 32 million tons of corn, 33 million tons of soybeans and 9 million tons of wheat traveling to Louisiana.

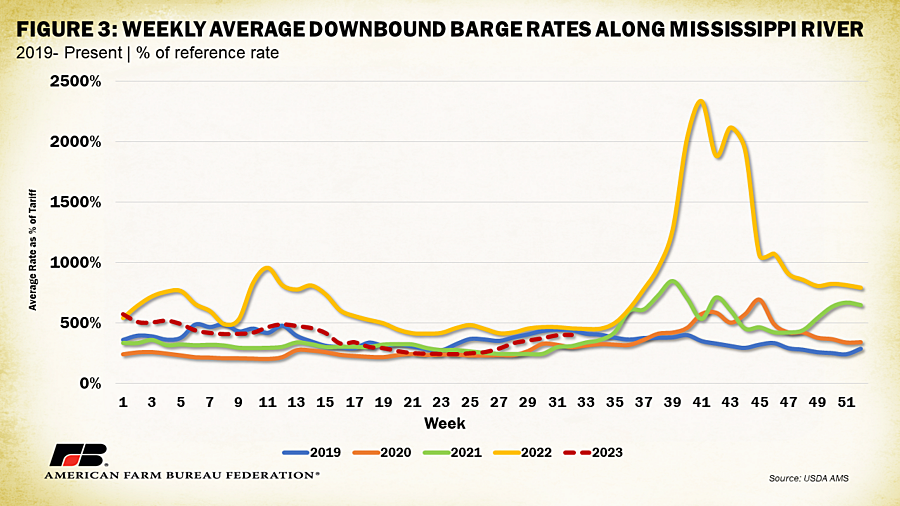

The industry generally responds to low water levels by reducing draft allowances (i.e., the depth a barge may sink into the water), which reduces the volume of goods moved (the greater the volume on a barge the deeper it sinks). Beyond draft allowances, the industry often reduces tow sizes, or the number of barges a single boat can tow. Combined, this means more barges will be needed to move the same quantity of products and more boats will be needed to move smaller groups of barges, pressuring capacity and slowing downstream user efficiency. Pressured capacity in barges and boats usually increases competition for transportation, pushing up costs for shippers looking to get product moved. Fortunately for farmers, shipping costs on the Mississippi River have not responded to impacts of low water levels, yet.

USDA’s Agricultural Marketing Service tracks weekly barge rates for downbound freight originating from seven locations along the Mississippi River system. The seven locations are: Twin Cities, a stretch along the upper Mississippi; Mid-Mississippi, a stretch between eastern Iowa and western Illinois; Illinois River, along the lower portion of the Illinois River; St. Louis; Cincinnati, along the middle third of the Ohio River; Lower Ohio, approximately the final third of the Ohio River; and Cairo-Memphis, from Cairo, Illinois, to Memphis, Tennessee. Carriers on the U.S. inland waterway system utilize a percent-of-tariff system to establish barge freight rates. The tariffs were originally from the Bulk Grain and Grain Products Freight Tariff No. 7, which were issued by the Waterways Freight Bureau (WFB) of the Interstate Commerce Commission (ICC). In 1976, the United States Department of Justice entered into an agreement with the ICC that deregulated barge rates and made Tariff No. 7 no longer applicable. Today, the WFB no longer exists, and the ICC has become the Surface Transportation Board, which does not have jurisdiction over barge rates on inland waterways. However, the barge industry continues to use the tariffs as benchmarks for rate units. Each city on the river has its own benchmark, with the northernmost cities having the highest benchmarks. They are as follows: Twin Cities = $6.19/ton; Mid-Mississippi = $5.32/ton; St. Louis = $3.99/ton; Illinois = $4.64/ton; Cincinnati = $4.69/ton; Lower Ohio = $4.46/ton; and Cairo-Memphis = $3.14/ton.

Figure 3 displays weekly average downbound barge rates for the seven locations since 2019. The rate represents the percent increase over the reference benchmark. During the week of August 16, average barge tariffs reached 401% over the underlying tariff, well in line with previous years but reflecting an eighth consecutive weekly increase. It is important to note, last year’s barge rates did not react to low river levels until September and October when rates soared to record levels over 2,000% of their underlying benchmark.

USDA’s grain transportation report indicated lower-than-average demand for grain transportation this summer, lessening the impact of low water levels on prices so far. For instance, barged grain movements in the second quarter of 2023 were down both from second quarter 2022 and the previous five-year average. For the week ending August 12, year-to-date 2023 total downbound barged grain tonnage at St. Louis was 10 million tons—28% lower than the same week last year and 25% lower than the previous four-year average. Part of this is linked to weaker export demand for marketing year 2022/23 and lower domestic grain stocks. When viewing Figure 4, recall the severe and widespread flooding that entirely stopped barge traffic for a total of 38 consecutive days between May and June 2019. It is estimated that approximately 6.3 million tons of grain worth almost $1 billion went unshipped due to closures that year.

Other parts of the country have received excessive levels of precipitation this summer. In mid-July parts of Vermont and New Hampshire received 9 inches of rain in 48 hours, flooding cropland and pastureland. In areas adjacent to overflowing rivers, farmers reported water levels over 10 feet. While a comprehensive assessment of total losses is not yet available for impacted states, an ongoing survey by Vermont’s Agency of Agriculture, Food & Marketshas reported live results from impacted producers. As of August 23, 251 producers in Vermont reported over $15.3 in million agricultural-related losses. Of that total, 7% ($1.07 million) was attributed to damage to infrastructure or equipment, 19% ($2.92 million) was attributed to damage to soil and or land, 40% ($6.14 million) was attributed to loss of crops meant for feed, and 34% ($5.22 million) was attributed to loss of crops meant for retail or wholesale markets. Note, this is a small fraction of Vermont’s over 6,000 farms and does not include losses from adjacent states. Over a third of respondents expect their cash flow to go negative within three months of the flooding with an additional 18.5% expecting negative cash flows within six months.

Hurricane Hilary was the first (at landfall) tropical storm to hit Southern and central California in over 80 years, a region that supplies much of the nation’s fruits, vegetables and tree nuts. High winds and heavy rains flooded waterways and fields and battered high-value crops nearing harvest maturity. California produces nearly 95% of grapes grown in the nation, with a value of over $5.2 billion. Grapes within several weeks of harvest can face quality and flavor decline if exposed to rain and muddy conditions. Footage of uprooted or bent vineyards from high winds signal expected losses with the storm. Many farmers also invested in preventative measures such as plastic coverings for orchards, a labor-intensive process, to protect crops prior to the storm taking place. This comes as many California farmers continue to recover from floodwaters.

Devasting wildfires on the Hawaiian island of Maui add to the long list of weather-related issues. High winds of Hurricane Dora swept fires across the island, in many places leaving only ash and skeletons of vehicles in its path. Hawaii Farm Bureau reports impacts to Hawaiian famers and residents below:

“While much of the attention is focused on the devastation in Lahaina, wildfires are continuing to burn in other areas of Maui. The wildfire in Upcountry Maui, where the town of Kula is located, is only 75% contained. Approximately 700 acres have burned, claiming 19 homes. We have farmers and ranchers in Kula that have been affected by wildfires and high winds from Hurricane Dora. In Kula, ranchers have lost pastureland and farmers have lost crops, structures and equipment. Farmers and ranchers across Maui have also lost sales to the restaurants, hotels and other businesses that were destroyed in Lahaina. Some farms lost their retail stores in Lahaina. The Hawaii Farm Bureau, along with the Maui County Farm Bureau, continues to assess the damage to our farmers and ranchers.”

- Randy Cabral President, Hawaii Farm Bureau, August 20th, 2023

Conclusion

Weather and climate-related disasters in 2023 continue to impact farms and ranches across the United States. These disasters come in addition to complex regulatory environments, above-average operating expenses, labor challenges and numerous other hurdles to operating a successful farm or ranch. Much uncertainty remains for farmers currently harvesting or planning to harvest crops in the near future, which will determine final 2023 farm income levels. The additional uncertainty of potential barge transportation disruptions due to low water levels in the Mississippi River is especially problematic during the harvest season, when farmers are looking to move grain to storage facilities.

U.S. farms and ranches must be resilient under an array of climate and weather conditions. The 2023 farm bill will give lawmakers a chance to fill gaps in existing risk management programs, providing similar risk management support for farmers regardless of what they grow. The sure and timely payments associated with crop insurance, disaster assistance, and other farm bill programs are often critical for farm-level stability, and ultimately for a safe and secure domestic food supply.